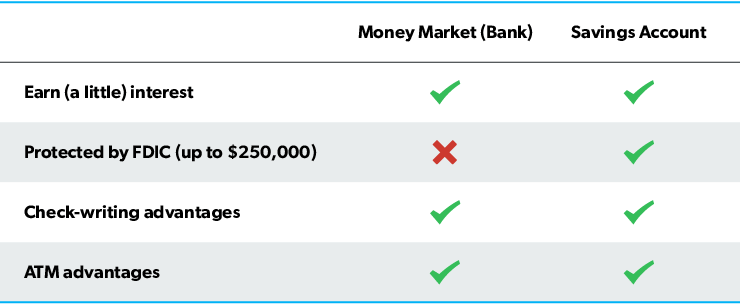

If inflation rises faster than interest rates, money market accounts lose some of their luster.įor example, the consumer price index - a gauge measuring inflation - rose 7% in 2021, but over that same time, the average money market account only accrued 0.09% interest in banks and 0.13% in credit unions. But if you parked that $10,000 in an interest-bearing MMA, you’d maintain more of your buying power because you’d earn some interest on the money.īanks tend to pay higher interest rates when inflation is high, but this isn’t always the case. Since money market savings accounts historically offer higher rates than traditional savings accounts, you can use them to help combat inflation.įor example, if the annual rate of inflation was 5% and you hid $10,000 of savings under your mattress, you would lose 5% of your buying power after a year. With money market savings accounts, your money is insured by the federal government, and you can’t lose any money like you might with an money market investment fund. Note that money market saving accounts are different from the similarly named money market funds, which are offered by investment firms. Some accounts reward larger balances with higher interest rates. MMAs often require a minimum deposit and balance to maintain, which can range from $0 to hundreds of thousands of dollars.

#MONEY MARKET ACCOUNT FREE#

Money market accounts typically come with a debit card, limited check-writing privileges and six free withdrawals per month. You should consult your personal tax and/or legal advisor concerning your individual situation.Credit unions and banks offer these interest-bearing accounts. Nothing on this website should be considered investment advice, or a recommendation or offer to buy or sell a security or other financial product or to adopt any investment strategy.įirst Horizon Advisors does not offer tax or legal advice. The contents of this website are for informational purposes only.

#MONEY MARKET ACCOUNT LICENSE#

Arkansas Insurance License # 100110355.įirst Horizon Advisors, Inc., FHIS, and their agents may transact insurance business or offer annuities only in states where they are licensed or where they are exempted or excluded from state insurance licensing requirements. The principal place of business of FHIS is 165 Madison Ave., Memphis, TN 38103.

(“FHIS”), a Tennessee corporation, and a subsidiary of First Horizon Bank. Insurance products are provided by First Horizon Insurance Services, Inc. Investment management services, investments, annuities and financial planning available through First Horizon Advisors, Inc., member FINRA, SIPC, and a subsidiary of First Horizon Bank. Trust services provided by First Horizon Bank. Insurance Products and Annuities: May be purchased from any agent or company, and the customer’s choice will not affect current or future credit decisions.įirst Horizon Advisors is the trade name for wealth management products and services provided by First Horizon Bank and its affiliates. Insurance Products, Investments & Annuities: Not A Deposit | Not Guaranteed By The Bank Or Its Affiliates | Not FDIC Insured | Not Insured By Any Federal Government Agency | May Go Down In Valueīanking Products and Services provided by First Horizon Bank. APY is variable and subject to change without notice. APYs listed are for accounts opened in the Tennessee market and can vary in other markets.

*** Standard Annual Percentage Yields (APY) are as of. ** Federal law requires that we convert a savings account to a checking account if you exceed six preauthorized or automatic debits or withdrawals per month, including transactions by check or similar order payable to a third party. Balances are considered together for purposes of FDIC insurance coverage. * $250,000 FDIC coverage refers to the total of all deposits that an account owner has at each FDIC-insured bank in different ownership categories. The account balance determines the Annual Percentage Yield (APY) paid for all funds in the account.įor additional information, please refer to the Depositor Agreement and Disclosure Statement. For additional information on service fees that may apply to this account, please visit our Account and Service Fee Summary page.

0 kommentar(er)

0 kommentar(er)